Article

Article

Blog Article

The AI Credit Repair Tools That Help You Build Credit

Maintaining a healthy credit score can sometimes feel like running a marathon without knowing where the finish line is. Timely credit card payments, disputing collections, removing public records—it can all get overwhelming pretty fast. But here’s the good news: You don’t have to do it alone anymore. With the rise of AI credit repair tools, keeping your credit in check is not only easier, but also more efficient than ever before. These AI-powered tools can help generate dispute letters, manage credit card utilization, remove public records, and even remind you when payments are due. And guess what? You can get started for free!

Why Is Credit Repair So Challenging?

Before we dive into the solution, let’s quickly talk about why maintaining a good credit score is such a hassle. Most people think it’s just about making credit card payments on time. Well, that’s a big part of it, but there’s so much more going on behind the scenes. Here’s a quick list of the common challenges:

- Timely Payments: Missing a single payment can hurt your score for months.

- Disputing Collections: Dealing with inaccuracies like unpaid collections or incorrect charges requires going through credit reports line by line.

- Public Records: Judgments, liens, and other public records can stay on your credit report for years, dragging down your score.

- Credit Utilization: Maxing out your credit cards even if you pay them off can still hurt your score.

All these factors work together to create the complex formula that is your credit score. Without the right tools, managing everything on your own can feel like trying to juggle with one hand tied behind your back.

How AI Tools Make Credit Repair Easier

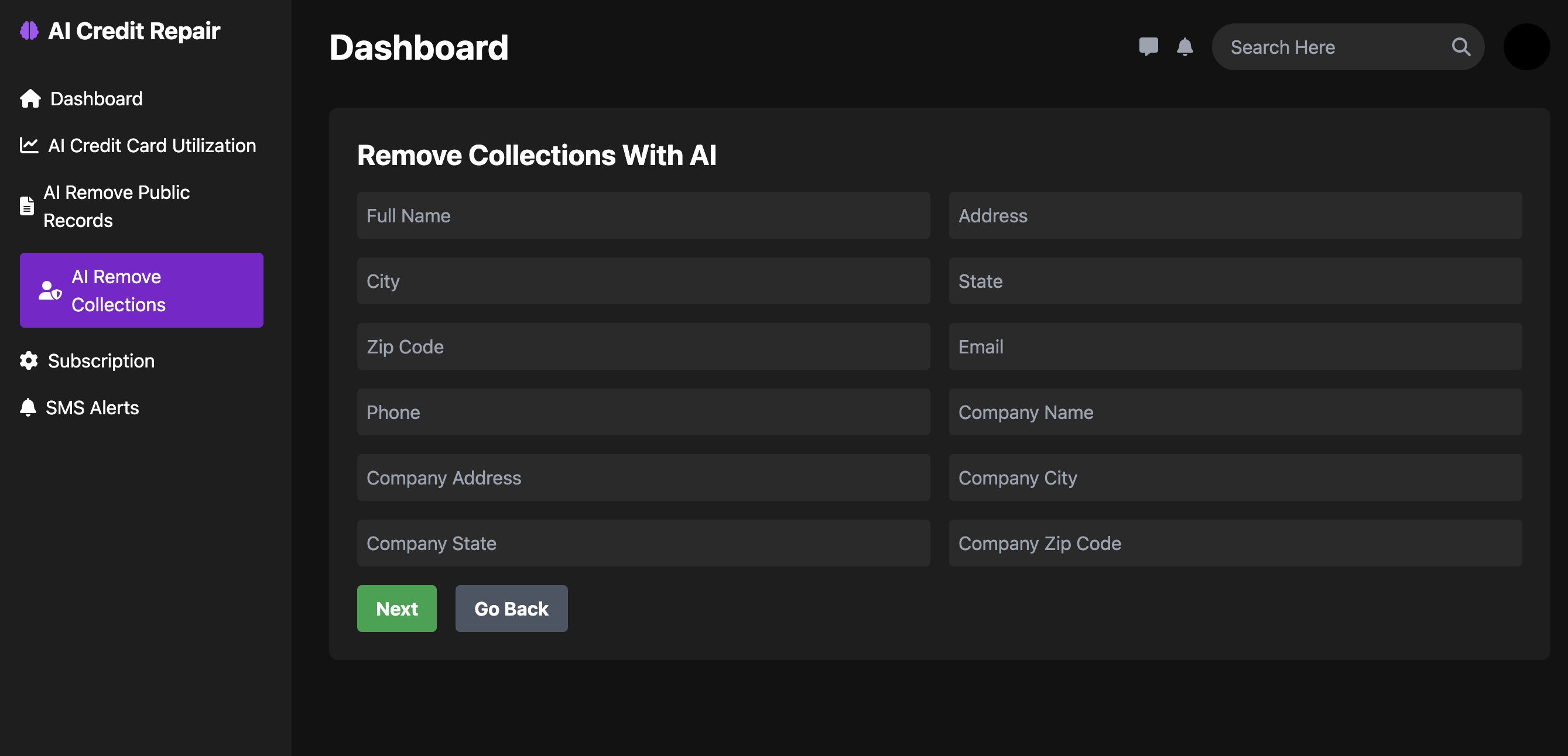

The game-changer here is AI. These smart tools can automate much of the grunt work for you, helping you focus on the things that matter most. Let’s break down how AI credit repair tools can help you build and maintain a strong credit score.

Generate Dispute Letters For Free

One of the best things about AI-powered credit repair tools is the ability to generate dispute letters for free. These letters are essential when it comes to challenging inaccuracies on your credit report. Maybe there’s a collection you paid off months ago but still shows up, or an error where someone else’s debt is linked to your report. AI tools can generate professional, well-structured dispute letters to send to credit bureaus, giving you a fighting chance to get those mistakes removed.

Even better, you can upgrade to a more sophisticated model that tailors the dispute letter to your specific issue. The AI takes into account relevant laws and regulations that apply to your dispute, increasing the likelihood of a successful resolution. Imagine having a letter that not only disputes the error but also cites specific legal precedents—now that’s powerful!

Remove Public Records with AI Assistance

Public records like tax liens, bankruptcies, and civil judgments can stay on your credit report for years, but that doesn’t mean you’re stuck with them forever. AI tools can help identify outdated or incorrect public records and guide you through the process of disputing them. Gone are the days of trying to understand complex legal jargon on your own. The AI can create removal requests that are more likely to succeed because they’re backed by legal authority.

Manage Your Credit Card Utilization

Most people don’t realize that using too much of your available credit, even if you pay it off in full each month, can negatively impact your score. AI tools can help you manage your credit card utilization by analyzing how much you’re using and suggesting ways to optimize it. These tools can offer tips like spreading your balance across multiple cards or paying down balances before they are reported to the credit bureaus.

Stay On Top Of Your Credit Card Payments

If you’re like me, you probably have multiple credit cards with different due dates. Keeping track of them all can be a nightmare. That’s why one of the standout features of AI credit tools is the payment reminder service. You’ll get SMS text reminders when your bills are due, ensuring you never miss a payment. It’s a simple yet highly effective way to stay accountable and keep your credit score intact.

Generate Dispute Letters Backed by Legal Authority

Now, this is where things get interesting. Not all dispute letters are created equal. Some are generic and lack any real punch. But the AI-powered dispute letters generated by these tools aren’t just your average run-of-the-mill forms. They are backed by legal authority, meaning they include references to the specific laws and regulations that support your dispute.

For example, if a debt collection agency is reporting a collection that’s past the statute of limitations, the AI can craft a letter citing that very law. This increases your chances of getting the negative item removed, as it shows you know your rights and are willing to take legal action if necessary.

Get Started For Free – No Strings Attached

The best part about all of this? You can get started for free. These AI credit repair tools offer a basic level of service without charging a dime. Whether you need a simple dispute letter or help managing your credit card payments, these tools have your back. If you find that the free services work well for you, you can always opt to upgrade to premium features for even more robust support.

Conclusion: Take Control of Your Credit With AI

Building and maintaining a good credit score doesn’t have to be a daunting task. Thanks to AI tools, you now have access to dispute letter generators, public record removal services, and credit card management systems—all designed to make credit repair simpler and more effective. Why struggle to do everything manually when you can let AI handle the heavy lifting? From sending payment reminders to crafting legally backed dispute letters, these tools are here to help you succeed.

Ready to take control of your credit score? Start using these AI tools today, and watch as your credit begins to improve—without the stress. Get started for free and see the difference for yourself!

Report this page